There has been much comment over recent weeks on what should happen and my two-pen’orth won’t add much to the debate. However, the ideas I put forward are ones raised at a fringe meeting at the Labour Conference I attended as a delegate all those weeks back in early October. The meeting had a panel consisting of a chair from ‘Nesta’, a charity trying to stimulate debate on topics in this case finance, two Labour MPs, and two economists who had been advisors to the treasury in previous governments. I was allowed one of the first question and had been desperate to put my idea to a wider audience to see how it landed. This was what I said (paraphrased).

Does the panel think that combining Tax and National Insurance into one type of ‘Income Tax’ allied to a graph where the rate of tax starts off low and curves up in very small increments, such that the more you earn the higher relative percentage of tax you pay, could be a way forward?’

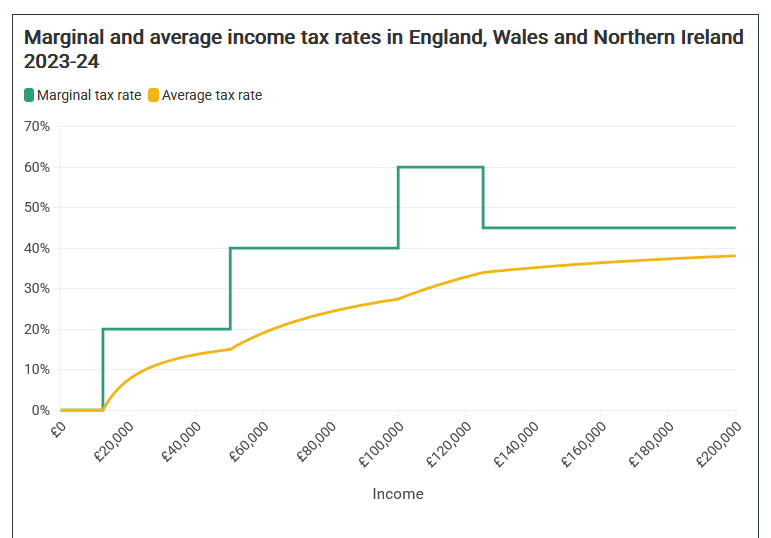

I was amazed that this landed extremely well particularly with the economists and I justified it by saying this had been proposed by the IFS in an article over ten years before. It has the beauty of overcoming the ridiculous cliff/edges/boundaries between the rates as shown below:

In my proposal the yellow line would not ‘tail off’ but increase steeply as earnings increase and keep going up even to about 80% or more when you get into individual earnings of £Millions. This graph is just for current income tax rates and doesn’t include NI and it’s various thresholds and bands – which is even harder to understand!

It is clear that most people don’t really understand why we have National Insurance – many think it relates to paying for the NHS/Pensions in some way that is not understood, and certainly the ‘stamp’ as it was called even when I started running payrolls in the mid-80s was a thing. The links are still there to benefit payments but in reality it all goes into the general taxation pot.

You can watch the event on this link.

https://www.nesta.org.uk/event/autumn-budget-2025-what-would-you-do-to-tax-and-spend-labour/

My question comes 23 minutes 30 seconds in and after some discussion on pensions from another questioner the panel come back to my question after three or four minutes. They discuss simplifying the whole tax system and later taxing unearned income in the same way as earned income.

Employers Contributions would be set as a percentage -say 5% of the curve amount -so also increasing with earnings. You could add to it things like minimum state or private pension contributions as per auto enrolment currently.

The reason most chancellors won’t do it is because it allows the press to say that the basic rate of ‘Tax’ has jumped from 20% to 28% and for higher earners it will go from 40% to 50% and for very high earners from 45% to 55%. But this over-simplification misses my point. That may be the rate for some of a person’s earnings but the ‘effective rate’ taking into account tax free earnings and different bands varies considerably. With some middle earners paying a higher actual rate than those on very high wages.

This brings me to my second ‘idea’ as prompted by the event at Conference. Why do we tax ‘unearned income’ and wealth differently to wages/salaries. The arguement goes that business owners and ‘entrepreneurs’ put in capital to start business and need to be rewarded for that risk. I agree, but when taking dividends or shares or capital gains adds to wealth but is taxed at lower overall rates, is that fair?

Why, as someone with a high state pension and a good private pension – which increases annually via the ‘triple lock’ – just because I am over 66, do I stop paying National Insurance on my earnings? This point was put by Tim Leunig, one of the economists on the panel (Visiting Professor in Practice at the London School of Economics’ School of Public Policy), who, like me lives in a high value house that is paid for, and has savings which keep growing year on year with little effort. Meantime our children and grandchildren some of whom are relatively well paid as IT professionals or teachers are struggling to get on the property ladder and finding day to day spending on children’s education and clothing and household bills tough going? As older people our cost to the NHS for instance grows every year. The old saying ‘..well we have paid our contributions for 40 years..’ may be true but why does that mean we stop?

While we were discussing with the panel Tim suggested that if you wanted to be really radical you could look at our ‘Tax Code’ and all the various regulations and minor taxes we have and scrap most of them which tinker around the edges and put it all on income/wealth. He has argued this in this week’s Substack blog’ he wrote along with another good idea of getting everyone together to design a system whereby we in the UK can become an ‘average tax-level’ nation comparing us with other countries. Follow this link for more detail – What should the Chancellor do this week?

Clearly there are many implications and details to be worked out, and wholesale changes in payroll systems will be needed. Better brains than mine will be able to work out exactly how the curve grows and how it relates to the actual tax receipts given the earnings spread. The advantage of this method is that at each budget the Chancellor will increase or reduce by a small percentage the rate at a point on the curve – say the mean salary level – depending on whether it has been a ‘good’ or ‘bad’ year. This flows ‘up and down the curve to the actual percentage paid on esrnings. The actual scale would increase with inflation.

So, rather than fiddling around the edges and the so-called ‘Smorgasbord’ of small taxes that has been trailed, Rachel Reeves could be known as a reforming chancellor who changed the debate on tax and came up with a system which is much more transparent and truly ‘progressive’. Wealth inequality is a serious issue in this country and I believe this will go some way to levelling the issue.

It would also mean that the whole industry of ‘tax accountants’ advising people which scheme to hide their money in, would go, to be replaced by one focussed not on ‘compliance’ but helping business grow their companies by systemising, getting some real increased productivity and growth.

VAT and ‘consumption taxes’

A quick point on another of Tim’s ideas we talked about in October was to reduce the rate of VAT but widen the scope. The example he used, was ‘Children’s Clothes’ – Zero Rated at present. But this means that a one pound babygro from Primark and a more expensive one from M&S and an even more expensive one at £190 from Burberry are all zero-rated…is that right? The pooerst households pay more in indirect taxes such as VAT and Council Tax as they ‘have to’ spend rather than save.

Some quick figures to provoke you while you are thinking about this. How do you compare…?

- Average Earnings excluding bonuses in September 2025 in the UK were approx £35,000 for a full-time worker.

- The Minimum wage will increase to £12.71 per hour from next April. £24,785 for a 37.5 hour week.

- The Real Living Wage – as calculated by a foundation is £13.45 per hour outside London from next May. £26,226 annually for a 37.5 hour week.

- 10% of people in the UK have no cash savings and another 21% have less than £1,000. Nearly half of 18-24 year olds have less than £1,000 saved.

- There is ‘pensioner poverty’, with 11% having no savings at all.